Politics

Trump’s ‘frontal attack’ on U.S. Fed sends global shockwaves – National TenX News

A U.S. Justice Department investigation at the U.S. Federal Reserve and a combative response by chair Jerome Powell have sharply raised the stakes in a long-running dispute that has put the independence of the world’s most powerful central bank openly on the line, investors said.

In a strongly-worded statement on Sunday, Powell disclosed a probe that threatened him with criminal indictment over a building renovation project, saying it was a “pretext” to gain political influence over the Fed to lower interest rates faster.

U.S. President Donald Trump told NBC that he had no knowledge of the Justice Department’s actions, but renewed his attacks on Powell that have grown more frequent and pointed as the Fed has chosen to cut rates more slowly than he would have liked.

The investigation and Powell’s pointed response sharply escalates a row that market observers fear risks upending the independence of the Fed, a bedrock of U.S. economic policy and a cornerstone of its financial system.

It also highlights how heavily the Trump administration’s efforts to reshape institutions from the military to the judiciary are now coming to bear on a pillar of U.S. financial strength.

The U.S. dollar was down – albeit modestly – against every major currency during the Asia session on Monday. Gold shot to a record high, U.S. stock futures dropped and markets priced in a slightly higher chance of short-term interest rate cuts.

The Canadian dollar shot up in value on Monday morning as the U.S. dollar fell.

“Fed Chair Powell has deviated from his previous approach to Trump’s threats, this time choosing to directly address the elephant in the room – that the Fed is not moving rates as the President would like,” said Damien Boey, portfolio manager at Wilson Asset Management in Sydney.

“Gold has strengthened, equities have wobbled, and the yield curve has steepened a little. These moves have been broadly consistent with the playbook for an attack on the Fed’s independence,” he said.

The ability of central banks to move, at least in setting interest rates, without political interference is considered a key tenet of modern economics – insulating monetary policymakers so they can make decisions for long-run stability.

For investors, trust in U.S. institutions forms part of the so-called “exorbitant privilege” that the country enjoys in financial markets as the issuer of the world’s reserve currency and recipient of billions of dollars in capital inflows.

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

Karl Schamotta, chief market strategist at Corpay in Toronto pointed to “unintended consequences” of leaning on the Fed.

“By trying to influence the central bank through aggressive legal threats against individual officials, the administration could drive inflation expectations higher, erode the dollar’s safe-haven role, and trigger a sharp rise in long-term bond yields that raises borrowing costs across the American economy.

“Pouring gasoline everywhere and then playing with matches tends not to work out well,” he said.

‘TECHNOCRATIC FED IS FADING FROM VIEW’

Powell’s pushback is in some sense a parting shot, since his term as chair is due to end in May and Trump has already promised his nominee as successor will be “someone who believes in lower interest rates, by a lot.”

But his stand will be a frame for any replacement and serve as a yardstick for shifts in the Fed’s approach.

Richard Yetsenga, ANZ’s group chief economist, said that for the U.S. financial markets in their entirety, the operation of all three of the Fed’s policy arms is likely to be in flux – rates, the balance sheet and banking sector regulation.

“It’s definitely too early (to tell), but the trends seem quite clear … the technocratic Fed, as we have understood it over the past few decades, is fading from view,” he said.

Meanwhile, investors, already starting to wonder whether their portfolios are over-allocated to the U.S., are on notice about the new kinds of risks the Trump administration is ushering in.

“The market has shaken off so much noise around the Fed and Fed independence and I think is probably likely to do it again, but at some point things will break,” said Christopher Hodge, chief U.S. economist for French investment bank Natixis.

To be sure, the market moves were small on Monday and some saw little clear consequence for interest rates and even as a sign that Trump actually lacked influence over the Fed.

“Investors won’t be happy about it, but it shows actually Trump has no other levers to pull,” said Andrew Lilley, chief rates strategist at Australian investment bank Barrenjoey.

“The cash rate will stay what the majority of the FOMC wants it to be,” he said, referring to the Federal Open Market Committee, which sets interest rates.

Still, nagging doubts about the freedom of the Fed to move as it sees fit in the future are now planted in investors’ minds.

“I think I’m still not sure how sustained and adversarial the attack on the Fed might be,” said Vishnu Varathan, head of macro research for Asia ex-Japan at Mizuho in Singapore.

“(But) the Fed independence question is now well and alive and maybe subject to re-evaluation every few meetings.”

– With a file from Global’s Ari Rabinovitch

Politics

IMF chief backs Jerome Powell, U.S. Fed independence amid Trump pressure – National TenX News

International Monetary Fund chief Kristalina Georgieva on Thursday underscored the importance of keeping central banks independent and threw her support behind beleaguered Federal Reserve Chair Jerome Powell, who is facing a Trump administration investigation for renovation cost overruns.

Georgieva told Reuters in an interview that there was ample evidence that central bank independence worked in the interest of businesses and households, and that evidence-based, data-based decision-making is good for the economy.

The IMF managing director said she had worked with Powell and respected his professionalism.

“I have worked with Jay Powell. He is a very good professional, very decent man, and I think that his standing among his colleagues tells the story,” she said, when asked about a letter of support signed by her predecessor, Christine Lagarde, now head of the European Central Bank, and other large central banks.

Powell on Sunday disclosed that the Trump administration had opened an investigation into him over cost overruns for a $2.5 billion project to renovate two historical buildings at the Fed’s Washington headquarters complex.

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

Powell denies wrongdoing and has called the unprecedented actions a pretext to put pressure on him for not bowing to U.S. President Donald Trump’s long-running demands for sharply lower interest rates.

The probe has sparked widespread criticism from some key members of Trump’s Republican Party in the U.S. Senate, which must confirm his nominee to succeed Powell, along with foreign economic officials, investors and former U.S. government officials from both political parties.

Trump has repeatedly derided Powell’s leadership of the Fed and attacked him, often personally, over what he sees as the Fed chair’s slow moves to cut interest rates. On Wednesday, he dismissed concerns that eroding central bank independence would undermine the value of the U.S. dollar and spark inflation, telling Reuters, “I don’t care.”

Georgieva said the IMF looked carefully at issues such as monetary and financial stability, as well as the strength of a country’s institutions. It was specifically interested in the Fed, given the role of the U.S. dollar as a reserve currency.

“It would be very good to see that there is a recognition … that the Fed is precious for the Americans. It is very important for the rest of the world,” she said.

Trump has also attempted to fire another Fed official, Governor Lisa Cook, who has challenged her termination in a legal case that will be argued before the Supreme Court next week.

Politics

B.C. Premier David Eby says province’s LNG, mining of interest to India TenX News

B.C. Premier David Eby spoke to reporters on Thursday morning from Mumbai, India, during his six-day trade mission.

He said that mining and energy companies in India are showing an interest in B.C.

“They are looking strongly to LNG as one of their ways of reducing carbon intensity, as well as reducing smog in the country,” Eby said.

“And so B.C. LNG has been an item of considerable interest, especially the projects that are reaching final investment decision over the next year — LNG Canada Phase 2, KSI Lisims LNG — as well as the projects that are under construction like Woodfibre LNG.”

Eby was also asked about the rise in extortion cases in B.C.

He said the province’s extortion task force will provide an update next week.

Get breaking National news

For news impacting Canada and around the world, sign up for breaking news alerts delivered directly to you when they happen.

“We have assembled a remarkable and historic task force, RCMP, CBSA,” Eby said.

“There are more police in Surrey right now than there have ever been. The RCMP has surged resources into the community.”

Eby said he has not been happy with the fact that there has been no update from the task force and he has asked them to provide one.

“There have been some important developments, people deported, an arrest here in India, cooperation between the Indian government and the Canadian government on this at the law enforcement level,” he added.

“That needs to continue, but, bluntly, we need better results, we need to see more arrests and whatever we can do to support the police to get the job done, we will do so.”

As of Jan. 12, Surrey police said there have been 16 reported extortion incidents in the city since the beginning of the year.

© 2026 Global News, a division of Corus Entertainment Inc.

Politics

Mexico confident CUSMA will remain as Trump suggests it could expire – National TenX News

Amid persistent doubts over the future of the Canada-United States-Mexico trade agreement (CUSMA), Mexico’s Economy Minister Marcelo Ebrard insisted on Thursday that the agreement remains firmly intact and that the three countries will close a deal to extend it.

“We’re already in the treaty review phase, and we have to finish by July 1; that’s our deadline,” Ebrard said during Mexican President Claudia Sheinbaum’s daily morning press conference.

“We have made good progress on all the points that concern each of the parties.”

Ebrard’s comments were his first on the topic since U.S. President Donald Trump again cast doubt on the treaty’s future earlier this week.

“There’s no real advantage to it, it’s irrelevant,” Trump said on Tuesday, as he toured a Ford factory in Dearborn, Michigan.

The trilateral trade agreement, known as USMCA, replaced the North American Free Trade Agreement in 2020 and is a backbone of Mexico’s economy.

The treaty, which was negotiated during Trump’s first term, requires the three countries to hold a joint review this year to extend the pact.

Get breaking National news

For news impacting Canada and around the world, sign up for breaking news alerts delivered directly to you when they happen.

If extended, the treaty will remain in place another 16 years. If not, it is subject to annual reviews.

Technically, July 1 is a key date in the treaty’s review process, but many analysts expect negotiations to extend late into 2026 and said Trump will likely avoid extending the treaty before the U.S. midterm elections in November.

Trump’s recent threats to pursue military action against cartels have also added a new layer of uncertainty to U.S.-Mexico relations.

“I think Ebrard is betting on a best-case scenario, but the window for a July successful review is closing fast,” said Alexia Bautista, a former Mexican diplomat and lead Mexico analyst at the political risk consultancy firm Horizon Engage.

“Given recent events and statements, the risk is that Trump injects security into the process, turning the trade review into a far more political negotiation.”

Pedro Casas, chief executive of the American Chamber of Commerce of Mexico, said he expects the U.S. will continue imposing tariffs on a wide spectrum of Mexican exports, regardless of the treaty’s future.

The Trump administration has imposed sweeping 50 per cent duties on steel and aluminum exports to the U.S., along with a 25 per cent tariff on cars shipped from Mexico, even when those vehicles comply with the terms of the trade deal.

“I think the most likely scenario is a positive review process where we agree to extend the treaty for another 16 years, but steep tariffs still remain on Mexican exports that undermine the strength of the agreement,” Casas said.

-

Fashion10 months ago

Fashion10 months agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment10 months ago

Entertainment10 months agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

TenX Exclusive10 months ago

TenX Exclusive10 months agoअमर योद्धा: राइफलमैन जसवंत सिंह रावत की वीरगाथा

-

Politics8 months ago

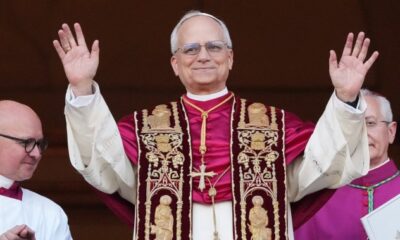

Politics8 months agoBefore being named Pope Leo XIV, he was Cardinal Robert Prevost. Who is he? – National TenX News

-

Politics9 months ago

Politics9 months agoPuerto Rico faces island-wide blackout, sparking anger from officials – National TenX News

-

Fashion10 months ago

Fashion10 months agoAccording to Dior Couture, this taboo fashion accessory is back

-

Tech10 months ago

Tech10 months agoIndian-AI-software-which-caught-30-thousand-criminals-and-busted-18-terrorist-modules-its-demand-is-increasing-in-foreign-countries-also – News18 हिंदी

-

Politics9 months ago

Politics9 months agoScientists detect possible signs of life on another planet — but it’s not aliens – National TenX News