Politics

Trump’s new tariffs on dozens of countries take effect – National TenX News

U.S. President Donald Trump began levying higher import taxes on dozens of countries Thursday, just as the economic fallout of his monthslong tariff threats has begun to create visible damage for the U.S. economy.

Just after midnight, goods from more than 60 countries and the European Union became subject to tariff rates of 10 per cent or higher. Products from the EU, Japan and South Korea are taxed at 15 per cent, while imports from Taiwan, Vietnam and Bangladesh are taxed at 20 per cent. Trump also expects the EU, Japan and South Korea to invest hundreds of billions of dollars in the U.S.

“I think the growth is going to be unprecedented,” Trump said Wednesday afternoon. He added that the U.S. was “taking in hundreds of billions of dollars in tariffs,” but he couldn’t provide a specific figure for revenues because “we don’t even know what the final number is” regarding tariff rates.

Despite the uncertainty, the Trump White House is confident that the onset of his broad tariffs will provide clarity about the path of the world’s largest economy. Now that companies understand the direction the U.S. is headed, the Republican administration believes they can ramp up new investments and jump-start hiring in ways that can rebalance the U.S. economy as a manufacturing power.

But so far, there are signs of self-inflicted wounds to America as companies and consumers alike brace for the impact of new taxes. What the data has shown is a U.S. economy that changed in April with Trump’s initial rollout of tariffs, an event that led to market drama, a negotiating period and Trump’s ultimate decision to start his universal tariffs on Thursday.

Economic reports show that hiring began to stall, inflationary pressures crept upward and home values in key markets started to decline after April, said John Silvia, CEO of Dynamic Economic Strategy.

“A less productive economy requires fewer workers,” Silvia said in an analysis note. “But there is more, the higher tariff prices lower workers’ real wages. The economy has become less productive, and firms cannot pay the same real wages as before. Actions have consequences.”

Even then, the ultimate transformations of the tariffs are unknown and could play out over months, if not years. Many economists say the risk is that the American economy is steadily eroded rather than collapsing instantly.

“We all want it to be made for television where it’s this explosion — it’s not like that,” said Brad Jensen, a professor at Georgetown University. “It’s going to be fine sand in the gears and slow things down.”

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

Trump has promoted the tariffs as a way to reduce the persistent trade deficit. But importers sought to avoid the taxes by importing more goods before the taxes went into effect. As a result, the $582.7 billion trade imbalance for the first half of the year was 38 per cent higher than in 2024. Total construction spending has dropped 2.9 per cent over the past year.

The economic pain isn’t confined to the U.S. Germany, which sends 10 per cent of its exports to the U.S. market, saw industrial production sag 1.9 per cent in June as Trump’s earlier rounds of tariff hikes took hold. “The new tariffs will clearly weigh on economic growth,” said Carsten Brzeski, global chief of macro for ING bank.

Dismay in India and Switzerland

The lead-up to Thursday fit the slapdash nature of Trump’s tariffs, which have been variously rolled out, walked back, delayed, increased, imposed by letter and frantically renegotiated. The process has been so muddled that officials for key trade partners were unclear at the start of the week whether the tariffs would begin Thursday or Friday. The language of the July 31 order to delay the start of tariffs from Aug. 1 only said the higher tax rates would start in seven days.

Trump on Wednesday announced additional 25 per cent tariffs to be imposed on India for its buying of Russian oil, bringing its total import taxes to 50 per cent.

A top body of Indian exporters said Thursday the latest U.S. tariffs will impact nearly 55 per cent of the country’s outbound shipments to America and force exporters to lose their long-standing clients.

“Absorbing this sudden cost escalation is simply not viable. Margins are already thin,” S.C. Ralhan, president of the Federation of Indian Export Organizations, said in a statement.

The Swiss executive branch, the Federal Council, was expected to hold an extraordinary meeting Thursday after President Karin Keller-Sutter and other top Swiss officials returned from a hastily arranged trip to Washington in a failed bid to avert steep 39 per cent U.S. tariffs on Swiss goods.

Import taxes are still coming on pharmaceutical drugs, and Trump announced 100 per cent tariffs on computer chips. That could leave the U.S. economy in a place of suspended animation as it awaits the impact.

Stock market remains solid

The president’s use of a 1977 law to declare an economic emergency to impose the tariffs is also under challenge. The impending ruling from last week’s hearing before a U.S. appeals court could cause Trump to find other legal justifications if judges say he exceeded his authority.

Even people who worked with Trump during his first term are skeptical that things will go smoothly for the economy, such as Paul Ryan, the former Republican House speaker, who has emerged as a Trump critic.

“There’s no sort of rationale for this other than the president wanting to raise tariffs based upon his whims, his opinions,” Ryan told CNBC on Wednesday. “I think choppy waters are ahead because I think they’re going to have some legal challenges.”

Still, the stock market has been solid during the recent tariff drama, with the S&P 500 index climbing more than 25 per cent from its April low. The market’s rebound and the income tax cuts in Trump’s tax and spending measures signed into law on July 4 have given the White House confidence that economic growth is bound to accelerate in the coming months.

Global financial markets took Thursday’s tariff adjustments in stride, with Asian and European shares and U.S. futures mostly higher.

Brzeski warned: “While financial markets seem to have grown numb to tariff announcements, let’s not forget that their adverse effects on economies will gradually unfold over time.”

As of now, Trump still foresees an economic boom while the rest of the world and American voters wait nervously.

“There’s one person who can afford to be cavalier about the uncertainty that he’s creating, and that’s Donald Trump,” said Rachel West, a senior fellow at The Century Foundation who worked in the Biden White House on labor policy. “The rest of Americans are already paying the price for that uncertainty.”

Politics

Canada talks trade with Qatar as Carney touches down in Doha – National TenX News

Prime Minister Mark Carney arrived in Doha on Saturday as part of a push to attract foreign investment and deepen Canada’s economic partnerships beyond its traditional allies.

Carney’s visit comes on the heels of his visit to China and follows the recent presentation of a new federal investment budget aimed at positioning Canada as a stable, attractive destination for global capital.

In a news conference on Saturday, Finance Minister François-Philippe Champagne said Canada is working to broaden its economic relationships as global trade patterns shift.

Qatar is viewed by Ottawa as a strategic partner, with officials pointing to the country’s significant investment capacity and growing influence on the global stage.

Get breaking National news

For news impacting Canada and around the world, sign up for breaking news alerts delivered directly to you when they happen.

“We need to reduce our dependence and increase our self-reliance to find a strategic path forward,” Champagne said.

“Engaging with the Middle East and China is necessary for Canada, just like our European partners have done,” Champagne added. “We buy more from the U.S.A. than anywhere else, but the trading climate right now is different.”

The conference highlighted Canada’s industrial capacity and trade advantages as key selling points for potential investors.

Champagne also said international engagement is critical as Canada works to raise its profile among global investors.

“We are one of the G7s with very big industries. We build cars, planes, ships, we have an abundance of energy, and we are the only one with free trade with all G7,” Champagne said. “With the way the world is changing, you better diversify, supply chain is changing and we need to adapt.”

Prime Minister Carney is expected to meet with senior Qatari officials, including Emir Sheikh Tamim bin Hamad Al Thani, as well as representatives of the Qatar Investment Authority.

His office says the talks will focus on expanding trade access and forging partnerships in artificial intelligence, infrastructure, energy and defence.

The visit comes amid heightened geopolitical tensions in the region, though officials say the schedule remains unchanged.

© 2026 Global News, a division of Corus Entertainment Inc.

Politics

How could Canada, EU, NATO respond to a U.S. takeover of Greenland? – National TenX News

The possibility of a forceful U.S. takeover of Greenland is raising many unprecedented questions — including how Canada, the European Union and NATO could respond or even retaliate against an ostensible ally.

A high-level meeting between Greenlandic, Danish and U.S. officials this week did not resolve the “fundamental disagreement” over the territory’s sovereignty but did set the stage for more talks. The White House made clear Thursday that U.S. President Donald Trump’s desire to control Greenland has not changed after the meeting.

“He wants the United States to acquire Greenland. He thinks it’s in our best national security to do that,” White House press secretary Karoline Leavitt said.

Denmark and European allies are sending more troops to the territory in a show of force and to display a commitment to Arctic security.

Experts say there are other, non-military measures available in the event of a U.S. annexation or invasion of Greenland, or which could at least be threatened to try and get Trump to back down.

Whether those economic measures are actually used is another matter, those experts say.

“I think it remains highly unlikely that we’ll get to that point where we have to seriously discuss consequences for a U.S. move on Greenland,” said Otto Svendsen, an associate fellow with the Europe, Russia, and Eurasia Program at the Center for Strategic and International Studies.

“So it remains contingency planning for a highly unlikely event. That being said … Denmark would certainly do everything in its power to rally a very robust European response.”

Here’s what that could entail.

EU trade, tech disruptions?

Experts agree the biggest pressure points that can be used in the U.S. surround trade and technology.

The European Parliament’s trade committee is currently debating whether to postpone implementing the trade deal signed between Trump and the EU last summer to protest the threats against Greenland, Reuters reported Wednesday.

Many lawmakers have complained that the deal is lopsided, with the EU required to cut most import duties while the U.S. sticks to a broad 15 per cent tariff for European goods.

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

An even bolder move would be triggering the EU’s anti-coercion instrument — known as the “trade bazooka” — that would allow the bloc to hit non-member nations with tariffs, trade restrictions, foreign investment bans, and other penalties if that country is found to be using coercive economic measures.

Although the regulation defines coercion as “measures affecting trade and investment,” Svendsen said it could feasibly be used in a diplomatic or territorial dispute as well.

“EU lawyers have proven themselves to be very creative in recent years,” he said.

However, David Perry, president of the Canadian Global Affairs Institute, said in an email that economic measures against the U.S. are unlikely “given the massive asymmetry in the defence and economic relationship between the U.S.” and other western nations.

“Any kind of sanction against the U.S. doesn’t make sense for the same reason they can impose tariffs on others: they have the power,” Perry added.

Target U.S. tech companies?

The likeliest — and potentially least harmful — scenario for retaliation in the event of an attack on Greenland, Svendsen said, would be fines or bans against U.S. tech companies like Google, Meta and X operating in Europe.

That’s because the Trump administration has taken particular focus on preventing what they call “attacks” on American companies by foreign governments seeking to regulate their online content or tax their revenues, which has led to calls on Canada, Britain and the EU to repeal laws like digital services taxes.

“I think that would be a really smart and targeted way to get to economic interests very close to the president, while minimizing the direct impact on the on the European economy,” Svendsen said, calling such a move “low-hanging fruit.”

He also compared a future U.S. tech platform ban to how Europe moved to wean itself off Russian gas after the full-scale invasion of Ukraine in 2022.

“If you told anyone back then that Europe would basically rid itself of its dependence on Russian gas basically within a two-year period … that would have been considered completely impossible,” he said.

“Weaning the European economy off of U.S. tech would certainly be painful in the short term, but they’ve proven that they can get off those dependencies quickly if there is political will behind it in the past.”

A U.S. hostile takeover of Greenland would mean the “end” of the NATO alliance, experts and European leaders have said.

Trump himself has acknowledged it could be a “choice” between preserving the alliance or acquiring Greenland.

There is no provision within the NATO founding treaty that addresses the possibility of a NATO member taking territory from another, and how the alliance should respond to such an act.

A NATO spokesperson told Global News it wouldn’t “speculate on hypothetical scenarios” when asked how it could potentially act.

“None of this would be actionable in a NATO sense,” Perry said. “It’s an alliance that’s organized to bind the U.S. to European security, and revolves around the U.S. So there’s no scenario of NATO doing that to the U.S.”

Denmark and other European nations could move to reduce or close U.S. military bases in their countries as a possible response, experts say.

Balkan Devlen, a a senior fellow at the Macdonald-Laurier Institute and director of its Transatlantic Program, said in an interview that a U.S. annexation of Greenland would force Canada to focus entirely on boosting its defences in the Arctic.

That may include trying to decouple from NORAD, the joint northern defence network with the U.S., in favour of a purely domestic Arctic command, he said — although that process would take years and require Canada to increase defence spending even further.

“Never mind five per cent (of GDP) — we will probably need to go like seven, eight, nine per cent on defence spending to be able to do anything of that sort,” he said. “It’s not even clear that we’ll be able to have enough people to do that.”

Devlen added that any retaliatory action, whether military or financial, needs to be targeted and proportionate to what the U.S. does.

“The problem with nuclear options is that once you use it, it’s gone,” he said. “And if it doesn’t do the damage or make the change of behaviour on the other party, you’ve basically lost a lot of leverage and you might actually sustain a lot more loss yourself.”

Politics

Louvre raises ticket prices for non-Europeans, hitting Canadian visitors TenX News

A trip to the world’s most-visited museum is about to cost Canadians significantly more.

France has hiked ticket prices at the Louvre by 45 per cent for visitors from outside the European Union, a move that is fuelling debate over so-called dual pricing and the growing backlash against overtourism.

Starting this week, adult visitors from non-EU countries, including Canada, must pay €32 to enter the Paris landmark, up from €22. That’s an increase from about $35 to $52 Canadian.

Visitors from EU countries, as well as Iceland, Liechtenstein and Norway, will continue to pay the lower rate.

The price hike comes as the Louvre grapples with repeated labour strikes, a high-profile daylight jewel heist last October that prompted a costly security overhaul, and years of chronic overcrowding. The museum attracts roughly nine million visitors annually.

Get breaking National news

For news impacting Canada and around the world, sign up for breaking news alerts delivered directly to you when they happen.

Some Canadian tourists told Global News they feel unfairly targeted.

“We didn’t cause the robberies or some of the other issues that happened and we are paying the consequences,” said Allison Moore, visiting Paris from Newfoundland with her daughter. “[In] Canada we don’t discriminate over pricing like that.”

Others argue tourists already shoulder higher costs simply by travelling long distances.

“In general for tourists, I think things should be a little cheaper than for local people, because we have to travel to come all the way here,” said Darla Daniela Quiroz, another Canadian visitor. “It should be equal pricing, or a little bit cheaper.”

Even some Europeans question the two-tiered system. A French tourist interviewed outside the museum said there was “no reason” to charge non-Europeans more and that the fee should be the same for everyone.

Tourism experts say the Louvre’s financial pressures help explain the decision.

“The Louvre is really cash-strapped right now and needs to do something,” said Marion Joppe, a professor at the University of Guelph. “It can’t really look to the government, which is already struggling with its own budget.”

The move also reflects a broader global pushback against mass tourism. Anti-tourism protests have spread across parts of Spain, New Zealand has increased its entry tax, and the United States recently raised national park fees for foreign visitors.

“You take Paris — it gets about 50 million tourists a year,” said Julian Karaguesian, an economist at McGill University. “That’s roughly a million a week. The city simply wasn’t built for those kinds of numbers.”

Despite the higher price, many visitors say they will still line up to see the Mona Lisa and other of the museum’s famous artworks.

“It’s one of the main attractions. It’s on everybody’s list,” Moore said. “We’re still going to go, and hopefully it will be worth it in the end.”

© 2026 Global News, a division of Corus Entertainment Inc.

-

Fashion10 months ago

Fashion10 months agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment10 months ago

Entertainment10 months agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

TenX Exclusive10 months ago

TenX Exclusive10 months agoअमर योद्धा: राइफलमैन जसवंत सिंह रावत की वीरगाथा

-

Politics8 months ago

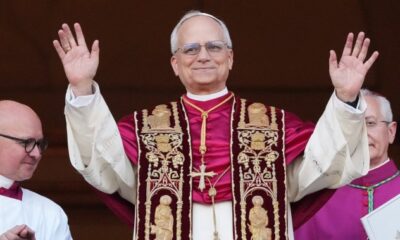

Politics8 months agoBefore being named Pope Leo XIV, he was Cardinal Robert Prevost. Who is he? – National TenX News

-

Politics9 months ago

Politics9 months agoPuerto Rico faces island-wide blackout, sparking anger from officials – National TenX News

-

Fashion10 months ago

Fashion10 months agoAccording to Dior Couture, this taboo fashion accessory is back

-

Tech10 months ago

Tech10 months agoIndian-AI-software-which-caught-30-thousand-criminals-and-busted-18-terrorist-modules-its-demand-is-increasing-in-foreign-countries-also – News18 हिंदी

-

Politics9 months ago

Politics9 months agoScientists detect possible signs of life on another planet — but it’s not aliens – National TenX News